In this Power BI Showcase, we’ll be reviewing insurance application reports that provide insights on our customer performance. You may watch the full video of this tutorial at the bottom of this blog.

The reports revolve around an insurance company that receives applications for different insurance-related products and deals.

We have information on the source of the applications and when they arrived. We can also view which customer or customer groups made the request and which relationship manager is handling them.

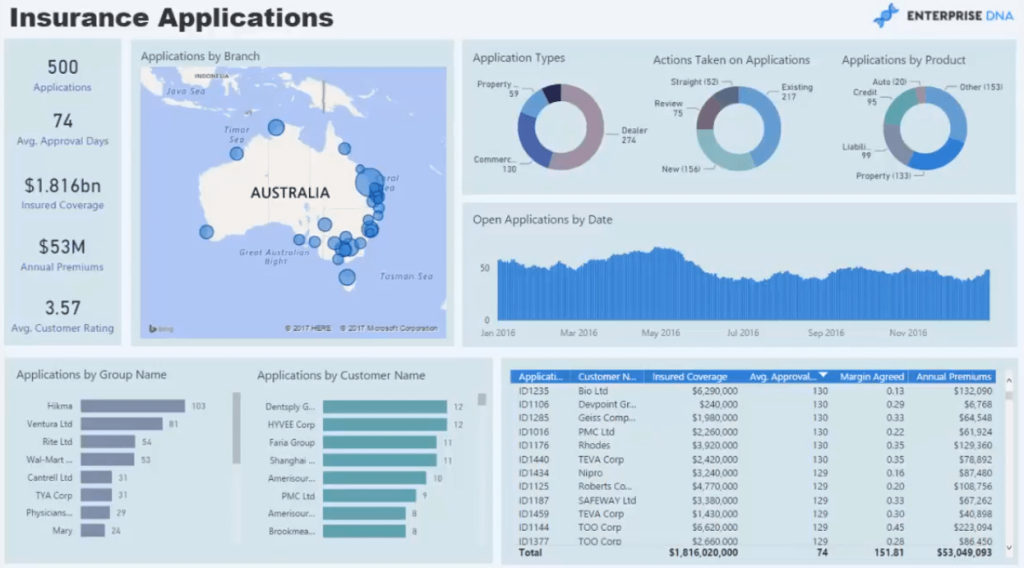

Insurance Applications Overview

In the first report, we can see an overview of the insurance applied by our clients.

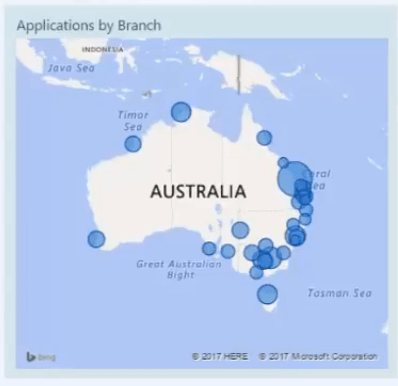

We can see where the applications are coming from through this visualization:

In the map, we can see which regions hold the biggest risk and revenue in terms of our premiums.

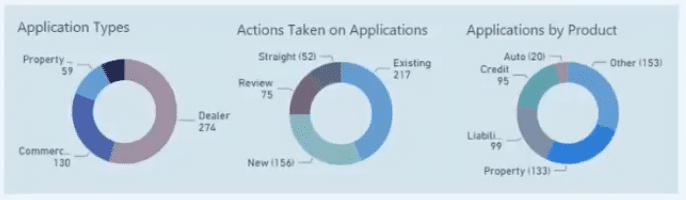

There are also donut charts showing the insurance coverage, actions taken, and the annual premium.

In this chart, we have information based on how many applications are open:

This is a great measure to see how efficient we are in terms of our application approval process. We can identify the number of applications that have been accepted or are still pending.

A good performance would be when we see a downward trend.

In this example, the number of open applications is higher than desired. There could be something in the system that’s causing the delay. This could be resolved with a bit of credit analysis. There could also be insufficient personnel managing the applications.

These are samples of the analysis that we could do with the information provided by this report.

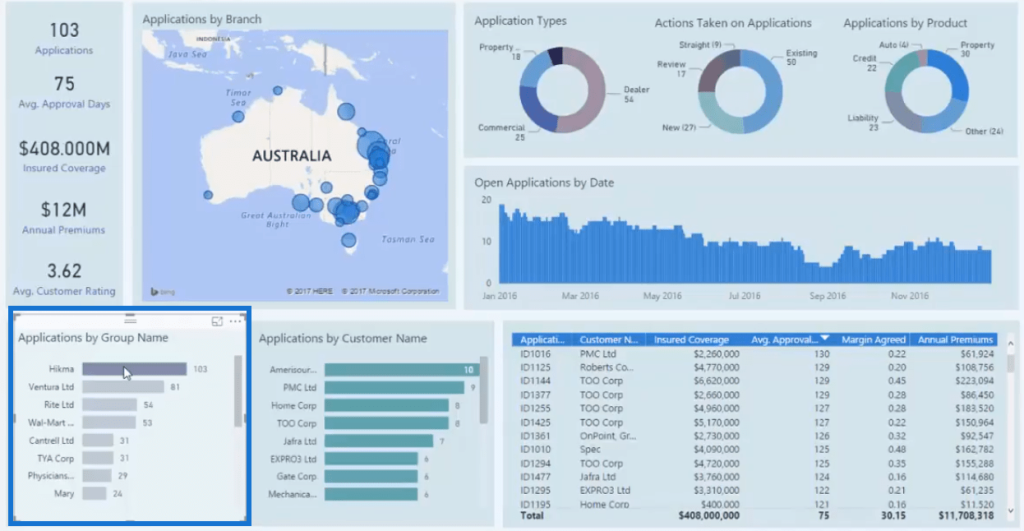

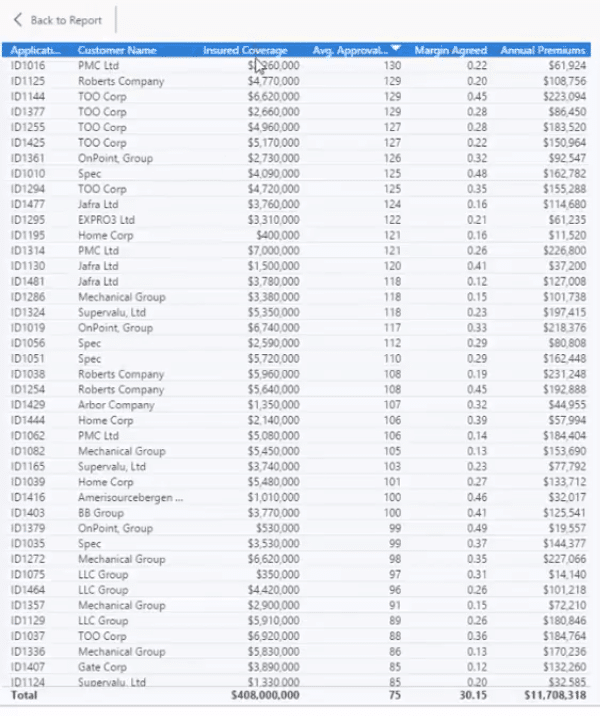

We can also dive into a specific customer group by clicking on the information in the chart.

A corporate group may want to review the status of their insurance. With this, we can easily give them the information they need.

We can also dive into each individual insurance transaction.

The customer will then be able to know the average approval time for applications, the margin achieved by the insurer, and the premiums.

Regional Analysis

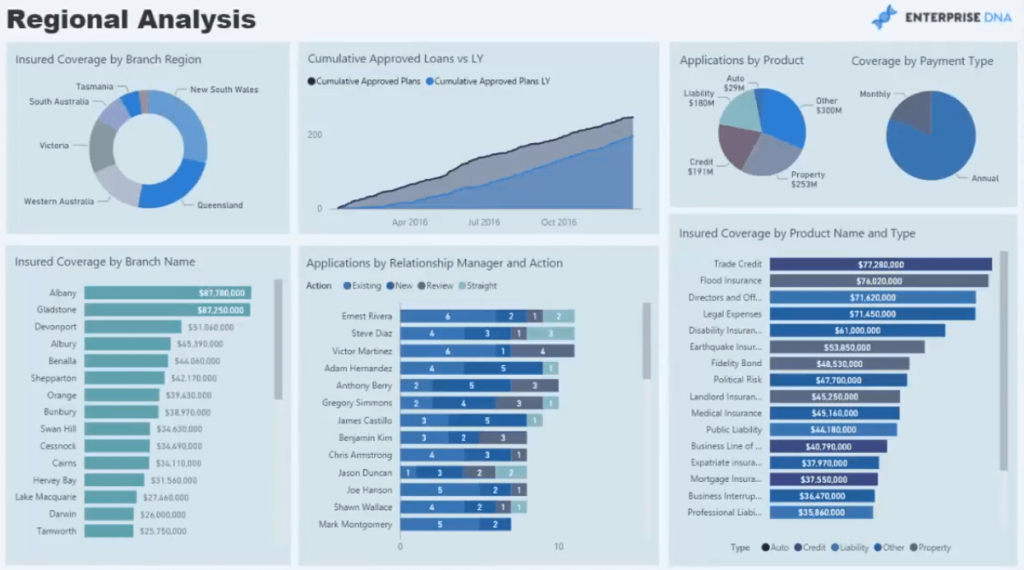

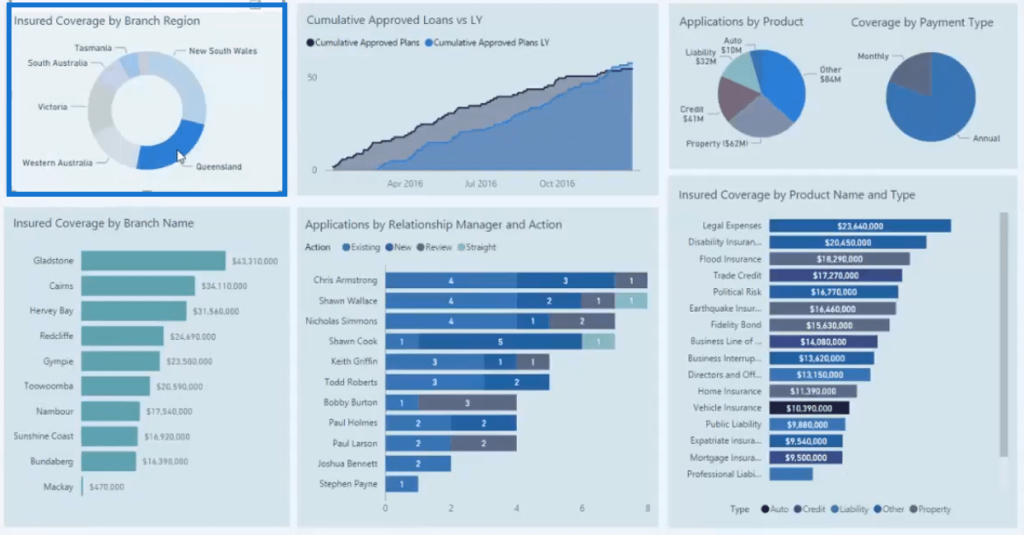

In the second report, we can see the status of our insurance applications by region.

We can dive into a specific region by clicking on the donut chart.

The report will show the company’s performance through time versus last year, and the insurance coverage per branch.

In this example, we can see Queensland’s breakdown for individual relationship managers and products, and understand how much insurance we’ve covered for this region.

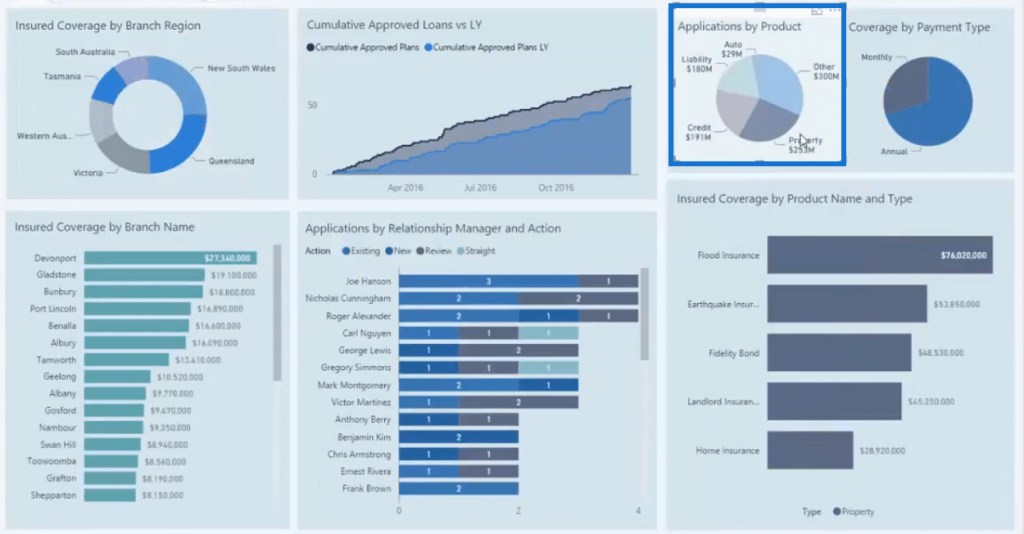

Apart from regions, we can also dynamically review the information from a product perspective. If we want to look at our property insurance, we simply need to click on the pie chart.

We can then drill into the product’s metrics and see in detail how they fare in different branches.

This can be done for all the products in the chart. All we need to do is select which product information we want to see.

Insurance Book Insights

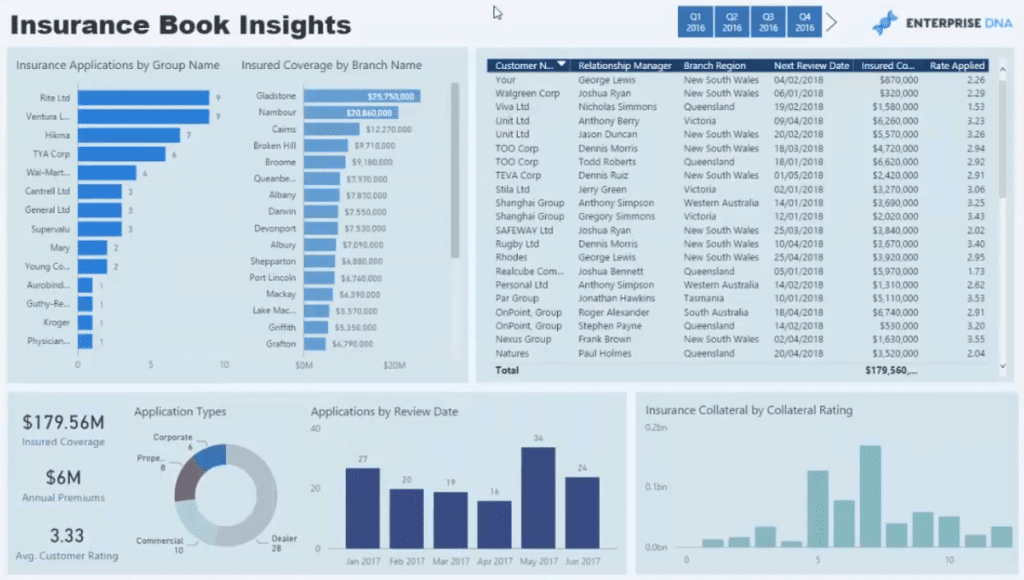

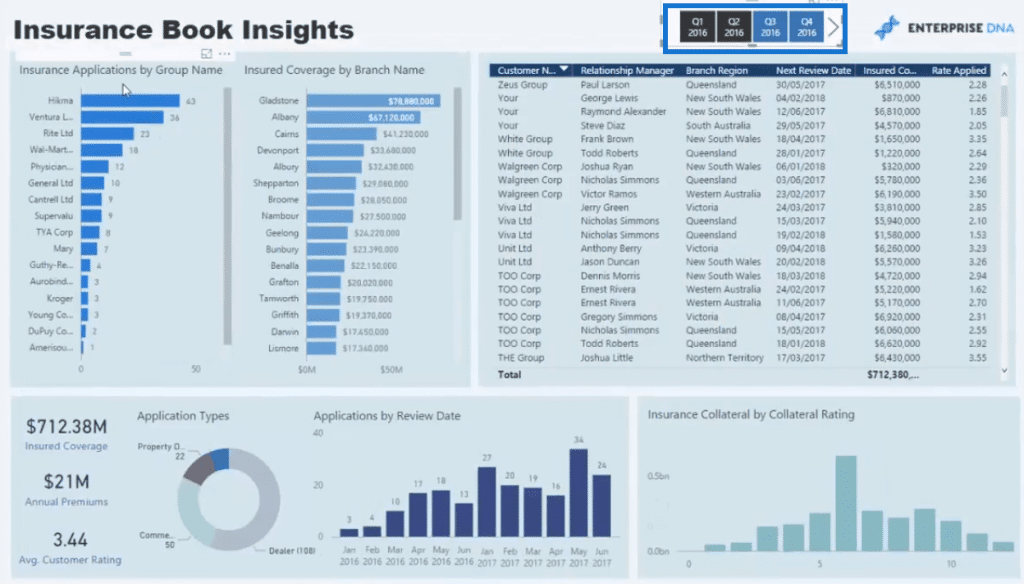

Lastly, we have a report that’s drilling deep into the insights of our insurance book.

We can look at an individual customer and identify how many applications they’ve made over a specific time frame.

There are charts for Applications by Group and by Branch name. There’s also a table that gives details on the next review date for each application or insurance product that we’ve sold to our customers.

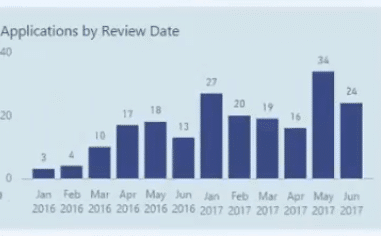

In this chart, we can see how many reviews are pending.

So, if you’re selling many insurance products, this chart is going to grow.

If we click on a specific day in this chart, it will dynamically show the insurance products we need to review to improve our metrics.

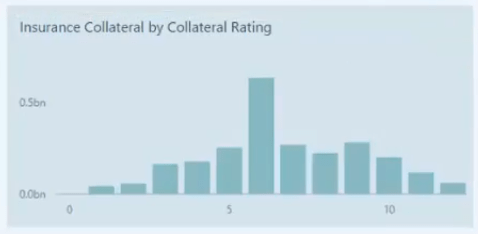

We also have a rating system for every insurance product.

This rating is in terms of the level of risk it brings to the insurer.

If we want a higher rating, it will also imply higher risk. The ideal rating is to have a normal distribution.

***** Related Links *****

Find Your Top Products For Each Region In Power BI Using DAX

Creating Compelling Power BI Dashboards With High Quality Insights

Showing The Last Three Customer Sales Using The TOPN Function

Conclusion

In this Power BI Showcase, we’ve focused on the applications and the insurance book information that an insurer may want to visually look at.

High-quality insurance reports need to bring real-time information for insurance-related activities.

The insights we can gather in real-time using this method of reporting and analysis in Power BI is a great tool for any business.

All the best,

Sam