Introduction to Credit Scoring and Risk Analysis

XGBoost is a powerful, open-source software library designed to implement gradient boosting. It is widely used in machine learning and data mining, making it a crucial tool for data scientists and analysts.

This tool has been praised for its scalability, speed, and accuracy, which are essential for solving complex data problems.

XGBoost can be used to predict customer churn, fraud detection, and demand forecasting. This algorithm helps in the accurate prediction of customer churn by identifying key factors that lead to customer attrition. The ability to forecast demand is also crucial for businesses to optimize their inventory management, resource allocation, and overall decision-making.

So, how do you get started with XGBoost?

In this article, we will go over the basics of using XGBoost and implementing it in a business setting.

We will also look at some examples to help you better understand the concepts.

Let’s get started!

Overview

Credit scoring and risk analysis are critical processes in the financial industry, which involve evaluating the creditworthiness of individuals or entities. This guide provides a comprehensive approach to implementing credit scoring and risk analysis using Python and the popular machine learning library XGBoost.

Prerequisites

Before we start, ensure you have the following:

- Python installed (preferably Python 3.8 or higher).

- Required Python libraries:

pandas,numpy,scikit-learn,xgboost, andmatplotlib. - A dataset containing historical credit information.

Setup Instructions

First, let’s ensure all necessary libraries are installed. Open a terminal or command prompt and run:

pip install pandas numpy scikit-learn xgboost matplotlib

Preliminary Concepts

Credit Scoring: This assesses the credit risk of a prospective borrower by assigning a score that predicts the likelihood of repayment. Models are often trained using historical data, such as past transactions, credit history, and borrower demographics.

Risk Analysis: This is the process of assessing the potential risks associated with lending money. It involves understanding the probability of default and the potential financial loss.

Dataset Preparation

Your dataset should typically contain the following types of features:

- Demographic Information: Age, Gender, Marital Status, etc.

- Financial History: Previous loans, payment history, default records, etc.

- Behavioral Data: Transaction patterns, credit card usage, etc.

Here’s a brief example of synthetic data preparation:

import pandas as pd

import numpy as np

# Create a synthetic dataset

np.random.seed(0)

data = {

'age': np.random.randint(18, 70, size=1000),

'gender': np.random.choice(['Male', 'Female'], size=1000),

'income': np.random.randint(30000, 120000, size=1000),

'loan_amount': np.random.randint(5000, 50000, size=1000),

'credit_history_length': np.random.randint(1, 20, size=1000),

'defaulted': np.random.choice([0, 1], size=1000, p=[0.9, 0.1])

}

df = pd.DataFrame(data)

print(df.head())

Data Preprocessing

Preprocess the dataset to handle missing values, encoding categorical variables, and scaling numerical features.

from sklearn.preprocessing import LabelEncoder, StandardScaler

# Handle categorical variables

df['gender'] = LabelEncoder().fit_transform(df['gender'])

# Standardize numerical variables

scaler = StandardScaler()

numerical_features = ['age', 'income', 'loan_amount', 'credit_history_length']

df[numerical_features] = scaler.fit_transform(df[numerical_features])

print(df.head())

Split the Dataset

Separate the dataset into features and target variables, then split into training and testing sets.

from sklearn.model_selection import train_test_split

X = df.drop(columns='defaulted')

y = df['defaulted']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=0)

Model Implementation with XGBoost

Now, implement the XGBoost model to predict credit scores.

import xgboost as xgb

from sklearn.metrics import accuracy_score, confusion_matrix, classification_report

# Initialize the XGBoost classifier

model = xgb.XGBClassifier(use_label_encoder=False, eval_metric='logloss')

# Train the model

model.fit(X_train, y_train)

# Make predictions

y_pred = model.predict(X_test)

# Evaluate the model

accuracy = accuracy_score(y_test, y_pred)

conf_matrix = confusion_matrix(y_test, y_pred)

class_report = classification_report(y_test, y_pred)

print(f"Accuracy: {accuracy * 100:.2f}%")

print("Confusion Matrix:\n", conf_matrix)

print("Classification Report:\n", class_report)

Conclusion

In this introduction, we’ve covered the initial setup and basic steps to prepare your data and build a credit scoring and risk analysis model using Python and XGBoost. In subsequent units, we will enhance the model’s complexity and accuracy, explore feature engineering, and implement more advanced evaluation techniques.

Python Basics and Environment Setup

This guide covers the bare essentials of setting up a Python environment to implement credit scoring and risk analysis using the XGBoost library. We will take a step-by-step approach, assuming you’re familiar with basic credit scoring concepts.

1. Install Python and Necessary Libraries

Ensure you have Python installed. Then, install the necessary libraries using pip.

pip install numpy pandas scikit-learn xgboost

2. Import Necessary Libraries

Start by importing the libraries we will need for data handling, preprocessing, and model training.

import numpy as np

import pandas as pd

from sklearn.model_selection import train_test_split

from sklearn.metrics import accuracy_score, confusion_matrix

import xgboost as xgb

3. Load and Explore Data

Load your dataset into a pandas DataFrame.

# Example to load data - use your actual dataset

df = pd.read_csv('your_dataset.csv')

# Preview the data

print(df.head())

4. Data Preprocessing

Prepare your data for model training by handling missing values, encoding categorical variables, and splitting the data.

# Handle missing values

df.fillna(method='ffill', inplace=True)

# Convert categorical columns to numerical

df = pd.get_dummies(df, drop_first=True)

# Split data into features and target

X = df.drop('target_column', axis=1) # replace 'target_column' with the actual target column name

y = df['target_column']

# Split the dataset into training and testing sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

5. Train XGBoost Model

Initiate and train the XGBoost model using the training data.

# Initialize the model

xgb_model = xgb.XGBClassifier(use_label_encoder=False, eval_metric='logloss')

# Train the model

xgb_model.fit(X_train, y_train)

6. Make Predictions and Evaluate the Model

Use the trained model to make predictions on the test set and evaluate its performance.

# Make predictions

y_pred = xgb_model.predict(X_test)

# Evaluate the model

accuracy = accuracy_score(y_test, y_pred)

conf_matrix = confusion_matrix(y_test, y_pred)

print(f'Accuracy: {accuracy}')

print(f'Confusion Matrix:\n{conf_matrix}')

7. Save the Model

You can save the trained model for future use.

import joblib

# Save the model

joblib.dump(xgb_model, 'xgb_credit_scoring_model.pkl')

Conclusion

You now have a working Python environment for credit scoring and risk analysis using XGBoost, from data loading to model training and evaluation. Apply this framework to your specific dataset and enhance by tuning hyperparameters or integrating advanced techniques as needed.

Follow these steps to integrate Python basics and environment setup into your larger project on credit scoring and risk analysis.

Data Collection and Preparation

In this section, you’ll learn how to collect and prepare data for credit scoring and risk analysis using Python. Let’s dive straight into the implementation:

Data Collection

Here, we’ll assume that the data can be fetched from a CSV file, a database, or an API. For simplicity, we’ll use a CSV file as our data source.

import pandas as pd

# Load data from a CSV file

data = pd.read_csv("credit_data.csv")

Data Inspection

Before proceeding to clean or prepare the data, it’s important to understand what it looks like.

# Display the first few rows of the dataset

print(data.head())

# Display basic statistics about the dataset

print(data.describe())

# Display information about the dataset

print(data.info())

Data Cleaning

Handling Missing Values

Identify and handle missing values. You can either drop these rows or fill them with appropriate values.

# Check for missing values

missing_values = data.isnull().sum()

print(missing_values)

# Fill missing values with the median of the column

data = data.fillna(data.median())

Handling Categorical Variables

Convert categorical variables into numerical values using one-hot encoding.

# Convert categorical variables (if any) into dummy/indicator variables

data = pd.get_dummies(data)

Removing Outliers

Remove outliers to improve the accuracy of the model.

# Removing outliers using the IQR method

Q1 = data.quantile(0.25)

Q3 = data.quantile(0.75)

IQR = Q3 - Q1

data = data[~((data < (Q1 - 1.5 * IQR)) | (data > (Q3 + 1.5 * IQR))).any(axis=1)]

Feature Scaling

Normalize or standardize the data for better model performance.

from sklearn.preprocessing import StandardScaler

# Initialize the StandardScaler

scaler = StandardScaler()

# Fit and transform the data

data_scaled = scaler.fit_transform(data)

Splitting Data into Training and Testing Sets

Split the data into training and testing sets to evaluate the performance of the model.

from sklearn.model_selection import train_test_split

# Define the feature variables and the target variable

X = data_scaled[:, :-1] # assuming the last column is the target

y = data_scaled[:, -1]

# Split the data (70% training, 30% testing)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42)

Summary

The above steps outline the practical implementation of data collection and preparation for credit scoring and risk analysis. Make sure to adapt the column indices and data paths based on your specific dataset. Here, the dataset has been scaled, cleaned, and split, making it ready for subsequent modelling steps using XGBoost.

Exploratory Data Analysis and Feature Engineering

Exploratory Data Analysis (EDA)

Step 1: Import Necessary Libraries

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

Step 2: Load the Data

# Assuming data is in a CSV file named 'credit_data.csv'

data = pd.read_csv('credit_data.csv')

Step 3: Data Overview

# Display the first few rows of the dataset

print(data.head())

# Display summary statistics

print(data.describe())

# Check for missing values

print(data.isnull().sum())

# Data types of each column

print(data.dtypes)

Step 4: Univariate Analysis

# Plot distribution of numerical features

numerical_features = data.select_dtypes(include=[np.number]).columns.tolist()

for feature in numerical_features:

plt.figure(figsize=(10, 5))

sns.histplot(data[feature], kde=True)

plt.title(f'Distribution of {feature}')

plt.show()

# Plot distribution of categorical features

categorical_features = data.select_dtypes(include=[np.object]).columns.tolist()

for feature in categorical_features:

plt.figure(figsize=(10, 5))

sns.countplot(data[feature])

plt.title(f'Distribution of {feature}')

plt.xticks(rotation=45)

plt.show()

Step 5: Bivariate Analysis

# Correlation matrix for numerical features

plt.figure(figsize=(12, 8))

corr_matrix = data.corr()

sns.heatmap(corr_matrix, annot=True, cmap='coolwarm', fmt='.2f')

plt.title('Correlation Matrix')

plt.show()

# Scatter plots for numerical features against target variable 'default'

for feature in numerical_features:

if feature != 'target': # Assuming 'target' is the target column for credit default

plt.figure(figsize=(10, 5))

sns.scatterplot(x=data[feature], y=data['target'])

plt.title(f'{feature} vs Target')

plt.show()

Feature Engineering

Step 1: Handling Missing Values

# Fill missing numerical values with median

data[numerical_features] = data[numerical_features].fillna(data[numerical_features].median())

# Fill missing categorical values with mode

data[categorical_features] = data[categorical_features].fillna(data[categorical_features].mode().iloc[0])

Step 2: Encoding Categorical Variables

# One-hot encoding for categorical features

data = pd.get_dummies(data, columns=categorical_features, drop_first=True)

Step 3: Feature Scaling

from sklearn.preprocessing import StandardScaler

# Initialize the scaler

scaler = StandardScaler()

# Scale numerical features

data[numerical_features] = scaler.fit_transform(data[numerical_features])

Step 4: Feature Creation

# Example of creating interaction features

data['feature1_feature2_interaction'] = data['feature1'] * data['feature2']

# Example of creating polynomial features

data['feature1_squared'] = data['feature1']**2

data['feature1_cubed'] = data['feature1']**3

Step 5: Feature Selection

from sklearn.feature_selection import SelectKBest, f_classif

# Select top 10 features

selector = SelectKBest(score_func=f_classif, k=10)

X = data.drop(columns=['target'])

y = data['target']

selected_features = selector.fit_transform(X, y)

# Get selected feature names

selected_feature_names = X.columns[selector.get_support()]

print("Selected features:", selected_feature_names)

Summary

By following these steps for Exploratory Data Analysis and Feature Engineering, the dataset is now preprocessed and ready for model building and evaluation using XGBoost in subsequent stages.

XGBoost and Model Training

1. Introduction to XGBoost

XGBoost (eXtreme Gradient Boosting) is a powerful, scalable, and high-performance gradient boosting library designed for machine learning. It is popular in Kaggle competitions and widely used in the industry for its speed and performance.

2. Installing XGBoost

Assuming your Python environment is already set up, install XGBoost using pip:

pip install xgboost

3. Importing Libraries

First, we’ll import the necessary libraries, including XGBoost.

import pandas as pd

import xgboost as xgb

from sklearn.model_selection import train_test_split

from sklearn.metrics import accuracy_score, roc_auc_score

4. Loading and Splitting Data

Load your prepared dataset and split it into training and testing sets.

# Placeholder for data loading code

# Ensure this data is already preprocessed according to your previous units

data = pd.read_csv('path_to_your_credit_scoring_dataset.csv')

# Assuming 'target' is the column with labels

X = data.drop(columns=['target'])

y = data['target']

# Split data into train and test sets

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

5. DMatrix: Optimized Data Structure

XGBoost provides DMatrix, an optimized data structure to maximize performance.

dtrain = xgb.DMatrix(X_train, label=y_train)

dtest = xgb.DMatrix(X_test, label=y_test)

6. Model Training with XGBoost

Set up the parameters and train the model.

# Set parameters for XGBoost

params = {

'objective': 'binary:logistic',

'max_depth': 6, # Tree depth

'eta': 0.3, # Learning rate

'eval_metric': 'auc' # Performance metric

}

# Train the model

num_round = 100 # Number of boosting rounds

bst = xgb.train(params, dtrain, num_round)

7. Model Evaluation

Predict the outcomes and evaluate the model using metrics such as AUC.

# Predict on test data

pred_prob = bst.predict(dtest)

pred_labels = [1 if x > 0.5 else 0 for x in pred_prob]

# Evaluate model's performance

accuracy = accuracy_score(y_test, pred_labels)

auc = roc_auc_score(y_test, pred_prob)

print(f'Accuracy: {accuracy}')

print(f'AUC: {auc}')

8. Save and Load the Model

Saving the trained model for future use:

# Save model to file

bst.save_model('xgboost_credit_scoring.model')

# Load the model from file

loaded_model = xgb.Booster()

loaded_model.load_model('xgboost_credit_scoring.model')

Summary

This section covers the practical steps to introduce and utilize XGBoost for credit scoring and risk analysis. You have learned how to install the library, preprocess data, train the model, evaluate its performance, and save/load the model. Apply these implementations to your prepared dataset for effective credit risk analysis.

Model Evaluation and Parameter Tuning

Model evaluation and parameter tuning are crucial steps for improving the performance of the XGBoost model in credit scoring and risk analysis.

6.1 Model Evaluation

Confusion Matrix, Accuracy, Precision, Recall, F1 Score, and AUC-ROC

First, let’s obtain a confusion matrix along with other key metrics.

from sklearn.metrics import confusion_matrix, accuracy_score, precision_score, recall_score, f1_score, roc_auc_score

# Assuming y_test and y_pred are already available from previous steps

conf_matrix = confusion_matrix(y_test, y_pred)

accuracy = accuracy_score(y_test, y_pred)

precision = precision_score(y_test, y_pred)

recall = recall_score(y_test, y_pred)

f1 = f1_score(y_test, y_pred)

auc = roc_auc_score(y_test, y_pred)

print("Confusion Matrix:")

print(conf_matrix)

print(f"Accuracy: {accuracy}")

print(f"Precision: {precision}")

print(f"Recall: {recall}")

print(f"F1 Score: {f1}")

print(f"AUC-ROC: {auc}")

6.2 Parameter Tuning with GridSearchCV

To find the optimal parameters for our XGBoost model, we will use GridSearchCV.

from sklearn.model_selection import GridSearchCV

import xgboost as xgb

# Define the parameter grid

param_grid = {

'max_depth': [3, 5, 7],

'learning_rate': [0.01, 0.1, 0.2],

'n_estimators': [100, 200, 300],

'subsample': [0.8, 0.9, 1.0],

'colsample_bytree': [0.8, 0.9, 1.0]

}

# Initialize the model

xgb_model = xgb.XGBClassifier()

# Set up GridSearchCV

grid_search = GridSearchCV(estimator=xgb_model, param_grid=param_grid, scoring='accuracy', cv=5, verbose=2, n_jobs=-1)

# Fit GridSearchCV

grid_search.fit(X_train, y_train)

# Extract the best parameters and best score

best_params = grid_search.best_params_

best_score = grid_search.best_score_

print(f"Best Parameters: {best_params}")

print(f"Best Score: {best_score}")

6.3 Evaluation with Best Parameters

Train the model with the best parameters obtained from GridSearchCV and evaluate its performance.

# Initialize the model with best parameters

best_model = xgb.XGBClassifier(**best_params)

# Fit the model

best_model.fit(X_train, y_train)

# Predict

best_y_pred = best_model.predict(X_test)

# Evaluate

best_conf_matrix = confusion_matrix(y_test, best_y_pred)

best_accuracy = accuracy_score(y_test, best_y_pred)

best_precision = precision_score(y_test, best_y_pred)

best_recall = recall_score(y_test, best_y_pred)

best_f1 = f1_score(y_test, best_y_pred)

best_auc = roc_auc_score(y_test, best_y_pred)

print("Confusion Matrix with Best Parameters:")

print(best_conf_matrix)

print(f"Accuracy with Best Parameters: {best_accuracy}")

print(f"Precision with Best Parameters: {best_precision}")

print(f"Recall with Best Parameters: {best_recall}")

print(f"F1 Score with Best Parameters: {best_f1}")

print(f"AUC-ROC with Best Parameters: {best_auc}")

This code provides the complete practical implementation covering model evaluation and parameter tuning using GridSearchCV for a credit scoring and risk analysis project in Python with XGBoost. Use this to evaluate your model and find the best parameters for enhanced performance.

Implementation in a Financial Context with Python and XGBoost

7. Credit Scoring and Risk Analysis Implementation

Here’s how you can implement credit scoring and risk analysis using Python and XGBoost, assuming you’ve completed the previous steps of data preparation, model training, and evaluation.

Import Necessary Libraries

import numpy as np

import pandas as pd

from xgboost import XGBClassifier

import joblib

Load Data

# Replace 'your_processed_data.csv' with your actual data file

data = pd.read_csv('your_processed_data.csv')

Feature Selection and Target Variable

Assuming you have processed your features and split them into independent variables X and target variable y.

X = data.drop('default', axis=1) # Feature set

y = data['default'] # Target variable

Implement the Model

Load the Pre-trained Model

Load the saved XGBoost model (assumed to be saved as ‘xgb_model.pkl’).

model = joblib.load('xgb_model.pkl')

Predict Credit Scores

Prediction

Using the trained model to predict the probability of default.

# Predict the probability of default for each client

probabilities = model.predict_proba(X)[:, 1] # Select the probability of the positive class

Attach Probabilities to Client Data

# Add probability scores to the original dataframe

data['probability_of_default'] = probabilities

Risk Analysis

Threshold Setting

Set a threshold to categorize the credit score. For example, classifying probabilities greater than 0.5 as risky.

threshold = 0.5

data['risk_category'] = np.where(data['probability_of_default'] > threshold, 'High Risk', 'Low Risk')

Analyze Risk Patterns

You can perform various analyses such as understanding distribution of high-risk clients in different features.

# Example: Analyzing the distribution of risk categories

risk_distribution = data['risk_category'].value_counts()

print(risk_distribution)

Save the Results

Save the dataframe with credit scores and risk categories to a new CSV file.

# Save the results

data.to_csv('credit_scores_with_risk_analysis.csv', index=False)

Conclusion

The outlined steps facilitate a practical implementation of credit scoring and risk analysis using a trained XGBoost model. This process includes predicting the likelihood of default, categorizing risk, and saving the outcomes for further analysis.

Deployment and Monitoring of the Model

1. Model Deployment

In this section, we will deploy our trained XGBoost model using Flask, a lightweight web application framework. We will create an endpoint where we can send data and get predictions in return.

Step 1: Save the Trained Model

Save the trained model to disk using joblib.

import joblib

# Save the model to a file

joblib.dump(model, 'xgboost_credit_model.pkl')

Step 2: Create a Flask Application

Create a new Python file, app.py, for the Flask application.

from flask import Flask, request, jsonify

import joblib

import numpy as np

# Load the trained model

model = joblib.load('xgboost_credit_model.pkl')

# Initialize Flask application

app = Flask(__name__)

# Define the prediction route

@app.route('/predict', methods=['POST'])

def predict():

data = request.get_json(force=True)

features = np.array(data['features']).reshape(1, -1)

prediction = model.predict(features)

return jsonify({'prediction': prediction.tolist()})

if __name__ == '__main__':

app.run(debug=True)

Step 3: Start the Flask Application

Run the Flask app.

python app.py

The API will be available at http://127.0.0.1:5000/predict.

Step 4: Test the API

You can test the API using curl or a tool like Postman.

curl -X POST -H "Content-Type: application/json" -d '{"features": [5.1, 3.5, 1.4, 0.2]}' http://127.0.0.1:5000/predict

2. Model Monitoring

Monitoring the model involves tracking its performance and ensuring it continues to make accurate predictions. This can be done by logging predictions and periodically evaluating the model on new data.

Step 1: Implement Logging

Modify the Flask app to log prediction requests and responses.

import logging

# Configure logging

logging.basicConfig(filename='model_predictions.log', level=logging.INFO, format='%(asctime)s:%(levelname)s:%(message)s')

@app.route('/predict', methods=['POST'])

def predict():

data = request.get_json(force=True)

features = np.array(data['features']).reshape(1, -1)

prediction = model.predict(features)

# Log request and response

logging.info('Request: %s', data)

logging.info('Response: %s', prediction.tolist())

return jsonify({'prediction': prediction.tolist()})

Step 2: Periodic Evaluation

Every month, you can evaluate the model with new data to ensure it remains accurate. You can automate this process using a cron job or a scheduled task.

Create a separate file, evaluate_model.py, to periodically check model accuracy.

import pandas as pd

import joblib

from sklearn.metrics import accuracy_score

# Load the model and new data

model = joblib.load('xgboost_credit_model.pkl')

new_data = pd.read_csv('new_data.csv')

# Assuming new_data has feature columns and a target column

X_new = new_data.drop('target', axis=1)

y_true = new_data['target']

# Make predictions and evaluate

y_pred = model.predict(X_new)

accuracy = accuracy_score(y_true, y_pred)

# Log the evaluation result

with open('model_evaluation.log', 'a') as f:

f.write(f'Accuracy: {accuracy}\n')

Automate the Evaluation

Use a cron job to schedule evaluate_model.py to run monthly.

# Open crontab

crontab -e

# Add the following line to schedule the evaluation (run on the 1st of every month at 12 AM)

0 0 1 * * /usr/bin/python3 /path_to_script/evaluate_model.py

Conclusion

Deploy the model using Flask to create a live prediction API, and add logging for monitoring. Periodically evaluate the model to ensure it maintains its performance over time. This approach will ensure your credit scoring application is robust and reliable.

Final Thoughts

As you wrap up, you should be proud of yourself for taking the first step towards understanding and implementing XGBoost in a business setting.

XGBoost is a powerful and versatile tool that can help businesses make better decisions, improve efficiency, and stay ahead of the competition.

It can be used for a wide range of tasks, from predicting customer churn to optimizing inventory management. By learning how to use XGBoost, you are equipping yourself with the skills needed to thrive in the fast-paced world of business and data science.

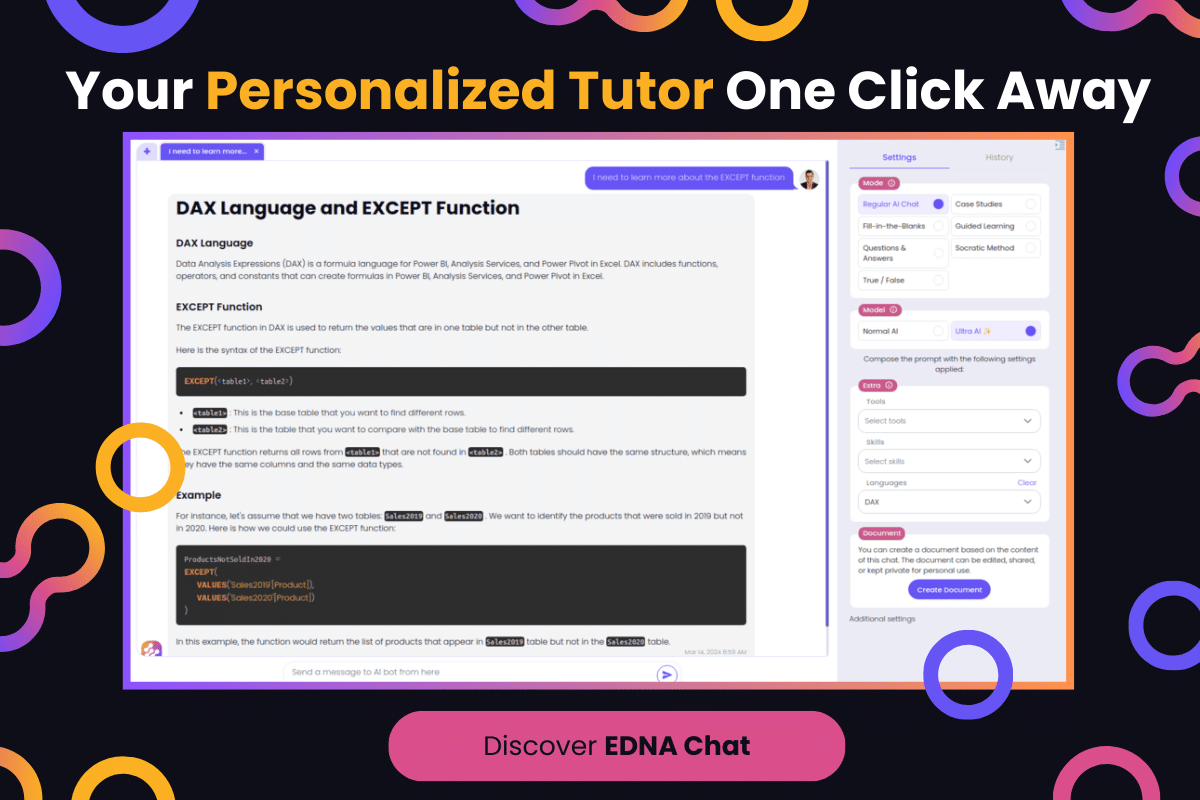

If you want to learn more about XGBoost, you can check out Enterprise DNA’s comprehensive learning platform.

Frequently Asked Questions

In this section, you will find some frequently asked questions you may have when using XGBoost in a business setting.

How to tune XGBoost parameters for business applications?

To tune XGBoost parameters for business applications, you should use techniques such as cross-validation, grid search, and random search.

This will help you find the optimal combination of parameters for your specific problem.

Common parameters to tune include learning rate, maximum depth, number of trees, and minimum child weight.

What is the process of integrating XGBoost with a database?

To integrate XGBoost with a database, you can use the DMatrix interface, which allows you to directly load data from a database.

Alternatively, you can load the data into a pandas DataFrame or numpy array and then convert it to DMatrix.

You can also use data parallelism to distribute the training process across multiple machines.

What is the best way to deploy an XGBoost model in a business environment?

The best way to deploy an XGBoost model in a business environment is to use a software package like MLeap, which can export your model into a format that can be easily loaded into a production environment.

You can also save the model using XGBoost’s native save/load functions and use it with a serving system like Apache Kafka.

How to work with sparse data using XGBoost?

To work with sparse data using XGBoost, you can use the DMatrix interface to load the data.

This will automatically handle the data sparsity and convert it into an internal data structure optimized for sparse data.

You can also use the “missing” parameter to specify the value used to represent missing data.

What is the role of learning rate in XGBoost?

The learning rate in XGBoost controls the contribution of each tree to the final model.

A lower learning rate requires more trees to achieve the same level of accuracy, but can lead to better generalization.

A higher learning rate can make the model learn faster, but may overfit the training data.

Typical values for the learning rate are between 0.01 and 0.3.

How to handle categorical data in XGBoost?

To handle categorical data in XGBoost, you can use one-hot encoding or label encoding.

One-hot encoding will create binary columns for each category, while label encoding will assign a unique integer to each category.

Another option is to use the “categorical_features” parameter in the DMatrix interface to specify which features are categorical.